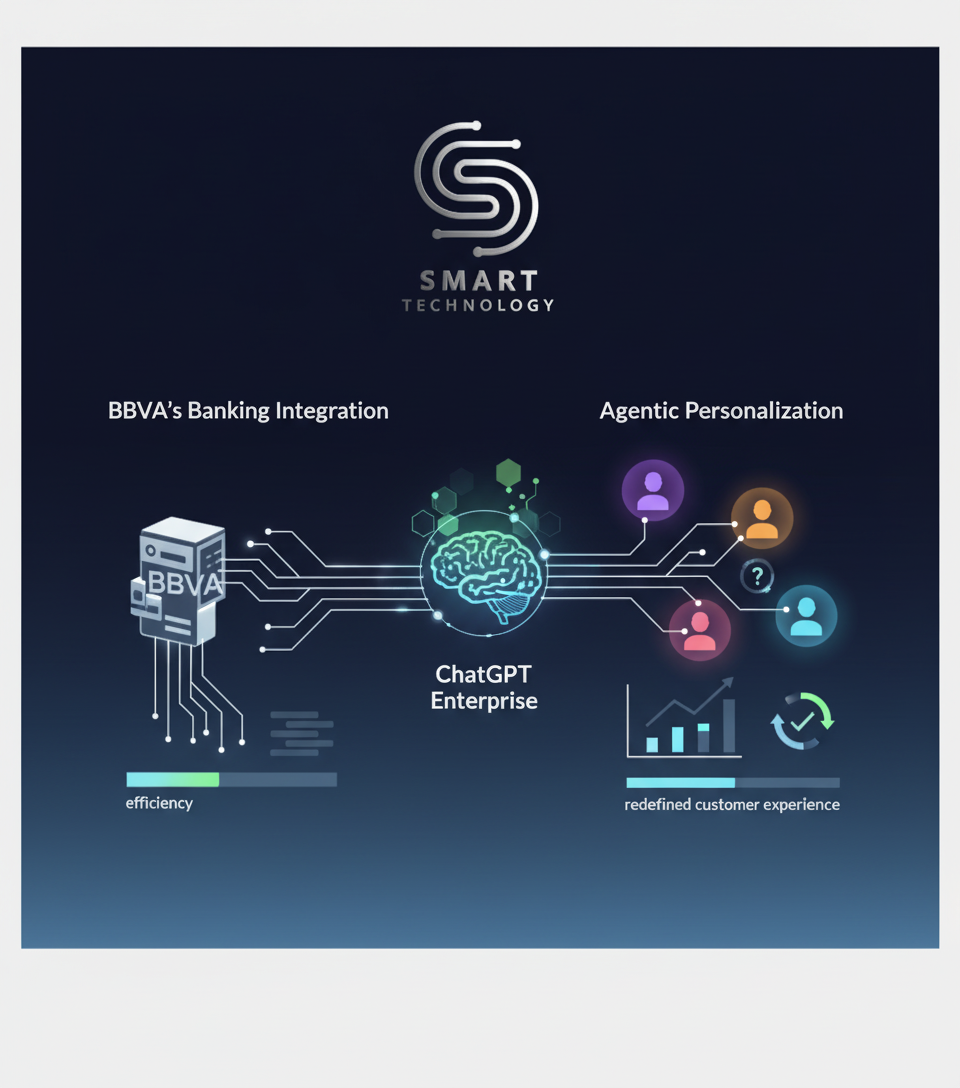

AI-Powered Efficiency: BBVA's Banking Integration and Agentic Personalization Redefine Customer Experience

AI-Powered Efficiency: Transforming Banking and Customer Experience

Two key developments in AI are poised to reshape how businesses, especially in the financial sector, operate and interact with customers:

BBVA Integrates AI with ChatGPT Enterprise

- Enhanced Workflows: BBVA is embedding AI into its banking workflows using ChatGPT Enterprise, streamlining operations and improving efficiency.

- Improved Productivity: By automating routine tasks and providing intelligent insights, AI helps banking professionals focus on more strategic initiatives.

Agentic Personalization Revolutionizes Customer Experience

- Intent-Driven Interactions: Agentic personalization focuses on understanding and addressing the underlying intent of end-users, leading to more relevant and satisfying customer experiences.

- Proactive Solutions: This approach enables businesses to anticipate customer needs and offer proactive solutions, enhancing loyalty and driving sales.

Impact on Business Owners

These advancements offer significant opportunities for business owners:

- Increased Efficiency: AI-driven automation reduces operational costs and improves productivity.

- Better Customer Engagement: Personalization enhances customer satisfaction and loyalty, driving revenue growth.

- Competitive Advantage: Early adoption of these technologies can provide a competitive edge in the market.

By leveraging AI, businesses can create more efficient, personalized, and customer-centric operations, ultimately leading to improved profitability and sustainable growth.